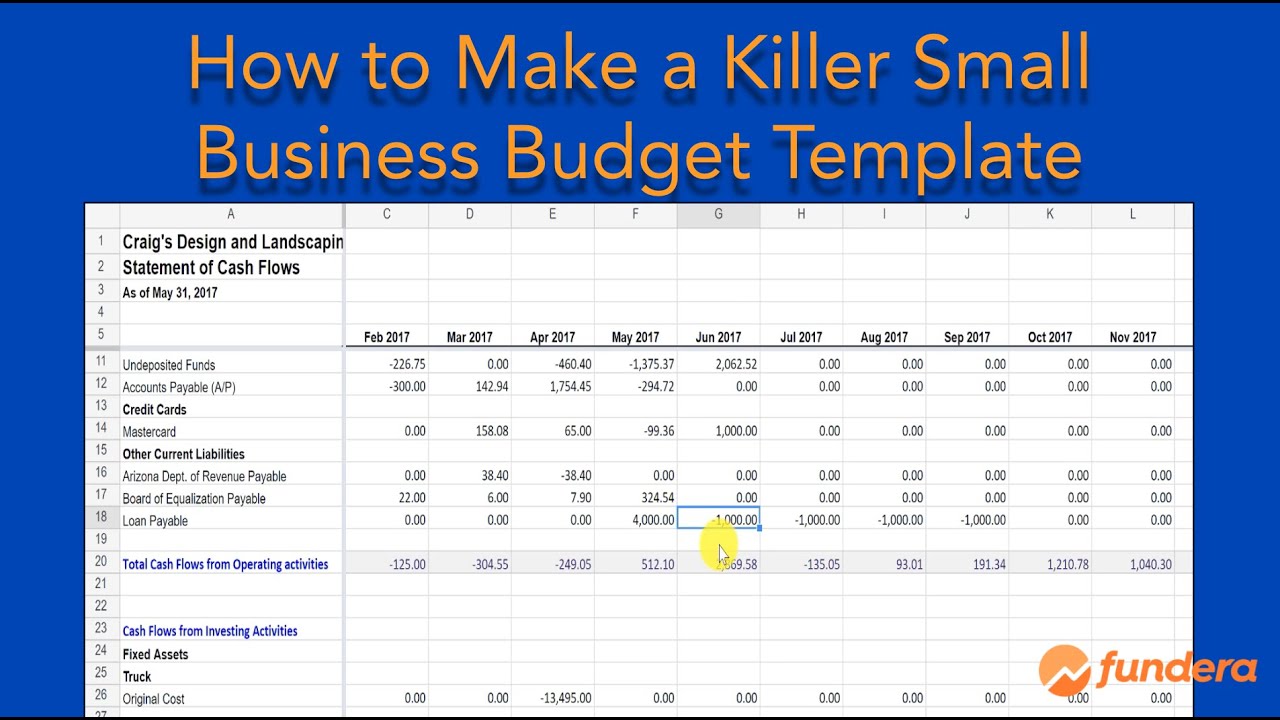

To avoid any problems with the Internal Revenue Service, you may use the categories included on their Schedule C tax form. The categories that you use for the columns of the spreadsheet will determine how you will break down the methods by which your business will spend money. This makes it easier for the business expense spreadsheet to serve its purpose. If you’re already familiar with Microsoft Excel, you can design an Excel expense template with the right formulas.

Small business expense spreadsheet template free download#

For this, you can either create it yourself or use a free template that you download online.īusiness expense spreadsheet 30 (49 KB) How do you keep track of business expenses and income in Excel? You should concentrate on making an expense sheet that is both effective and perfect. Their inclusion gives you the opportunity to make improvements so that the next time around, you will only concentrate on what matters. If you list down the expenses, it becomes easier for you to create categories or add to existing groups.įrom the list you have gathered, start categorizing the operating costs into either variable, periodic or fixed expenditures. It’s like clearing your mind so you have that option to customize the document to serve its purpose. It’s recommended to start with a clean sheet when creating the report. You may create your own monthly expenses template by following these guidelines: This document only tracks the money that you have spent. It accounts for all of the expenses your business has incurred. You can simplify this process if you consider using one debit or credit card when making business-related expenses.Ī business expense spreadsheet is a comprehensive report created on a regular basis. Make sure that you keep all receipts of any business-related purchase you make when tracking business expenses. Either way, use an expense tracker template for documentation purposes. There is also the accrual method which counts sales when you make them even if they haven’t gotten paid yet and expenses when you receive a purchase or a service even if these haven’t gotten paid yet. The practice of most small businesses when tracking expenses is by using the cash accounting method where you record income when you receive it and expenses when making payments.

Choose your accounting method for your business.It also serves as an assurance that you will claim the exact amount of tax-deductable expenses come tax season. If you keep these expenses separate you will have a better understanding of your business’ costs. Separate business and personal expenses.The following steps can make your expense tracking easier and faster: Doing this makes it easier for you to claim tax-deductible business expenses. To ensure that your business will always have updated financial information, you need to keep track of your business expenses using a business expense spreadsheet. You may use one or more of this expense report template depending on your organization’s accounting practices and payment structure.īusiness expense spreadsheet 20 (65 KB) How do businesses keep track of expenses? Generally, expenses reports get filed on an annual, quarterly or monthly or weekly basis. In most cases, the expense types and expenses have been pre-approved by the management to align with budgets and, as such simplifies reconciliations in the future. This report reports and tracks all of the attributable expenses incurred during a specific project.

As such, the report acts both as an expense report and a budget because it provides an added layer of data that makes sure that the event stays on track. Use this template to track estimated against the actual cost for each aspect of an event.

Companies can keep track of this information through this template. While it is true that the company will save money that it would have spent on a rented car, it has to compensate the employee for the time they used their car. In many cases, employees use their personal vehicles for business trips. This template is primarily used to organize charges for meals, transportation, and hotels including the mileage of the car that you use. These are especially appropriate for start-up companies and small businesses because they’re very simple. Use this template to record the payment method, date, expense description, vendor, and amounts. Making your own report template doesn’t have to be a challenge as long as you know what type of template you need: You need a system for your business to keep track of how much you’re spending – and you will benefit a lot from using a business expense spreadsheet. Business expense spreadsheet 10 (38 KB) Types of spreadsheets for business expenses

0 kommentar(er)

0 kommentar(er)